For many Australians, getting into the property market feels like a distant dream. Saving a 20% deposit while property prices keep rising can make homeownership seem out of reach, especially for first home buyers. That’s why the Federal Government’s announcement to expand the Home Guarantee Scheme (HGS) has been making headlines.

Even better news? The Government has confirmed the expanded scheme will now launch on 1 October 2025, three months earlier than originally planned. This earlier start date gives first home buyers an opportunity to enter the market sooner — but it also means preparation is critical.

In this article, we’ll cover exactly what’s changing, how the scheme works, what it could mean for the property market, and why planning ahead is more important than ever.

What Is the Home Guarantee Scheme?

The Home Guarantee Scheme is an initiative designed to help Australians buy their first home without having to save the traditional 20% deposit. Under the scheme:

- First home buyers can purchase a property with as little as a 5% deposit.

- The Government acts as guarantor for up to 15% of the loan, meaning buyers don’t need to pay Lenders Mortgage Insurance (LMI).

- This can save buyers tens of thousands of dollars upfront, reducing one of the biggest barriers to entering the property market.

Until now, the scheme was capped by income limits, property price thresholds, and limited places available each year. With the upcoming expansion, the barriers have been significantly lifted.

What’s Changing from 1 October 2025?

The expanded Home Guarantee Scheme comes with three major changes:

- Earlier start date – The expansion will now begin on 1 October 2025, giving first home buyers access sooner.

- Higher property price caps – Maximum purchase prices have been lifted substantially across capital cities and regions.

- More buyers included – The expansion makes the scheme accessible to more first home buyers, increasing opportunities to purchase in high-value markets.

- No income caps – First home buyers with higher incomes can access the Scheme.

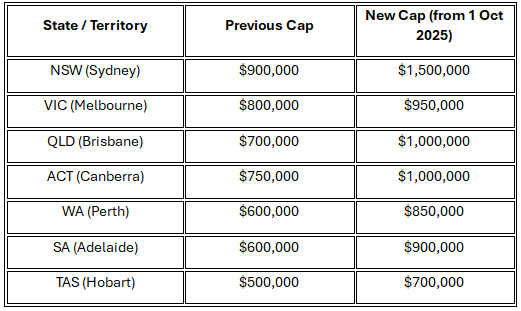

Here’s a look at the new property price caps compared to the previous limits:

Note: Regional property caps have also increased. A Natloans broker can help you confirm the maximum cap in your preferred area.

Why This Matters for First Home Buyers

The expanded Home Guarantee Scheme could be a game-changer for many Australians, but it also comes with new dynamics that first home buyers need to consider:

- More Buying Power – With the higher property price caps, first home buyers can look at properties that were previously out of reach.

- Significant Cost Savings – Skipping LMI could save between $10,000 and $30,000 (or more), depending on the purchase price.

- Earlier Opportunity – Since the scheme now begins in October, buyers have less time to get prepared.

- Increased Competition – Experts warn that more buyers entering the market at once could create upward pressure on property prices, particularly in capital cities.

How First Home Buyers Can Prepare

If you’re a first home buyer considering the scheme, preparation is key. Here are some practical steps to take before 1 October:

- Get Pre-Approved – A pre-approval gives you a clear idea of your borrowing capacity and ensures you’re ready to act quickly when the scheme launches.

- Understand Your Price Cap – Each city and region has a specific property price threshold. Knowing yours will help you refine your property search.

- Plan Your Budget Carefully – While a 5% deposit sounds attractive, it also means a larger loan balance. Make sure repayments fit comfortably within your budget.

- Seek Expert Guidance – A mortgage broker can help you compare lenders, find competitive rates, and make the most of the Home Guarantee Scheme.

The Bottom Line

The expansion of the Home Guarantee Scheme from 1 October 2025 is a major opportunity for first home buyers to get into the market sooner, with less savings required and without the burden of LMI. With property price caps now significantly higher, buyers in Sydney, Melbourne, Brisbane, and other capitals have access to a much broader range of properties.

But with greater demand and the earlier start date, it’s essential to plan ahead. Getting pre-approved and having a clear strategy will give you the best chance of success.

Your First Home, Made Simple with Natloans

At Natloans, our experienced brokers have helped thousands of Australians buy their first home. We understand the ins and outs of the Home Guarantee Scheme, the lender policies that apply, and how to structure finance so that you can buy with confidence.

If you’re a first home buyer thinking about using the Home Guarantee Scheme, now is the time to start planning. A conversation with a Natloans broker today could be the step that helps you become a homeowner sooner.

Contact Natloans to speak with an experienced mortgage broker and explore your options.

Frequently Asked Questions – Home Guarantee Scheme

1. What is the Home Guarantee Scheme?

The Home Guarantee Scheme is a Federal Government program that helps eligible buyers purchase a property with as little as a 5% deposit. The Government guarantees up to 15% of the loan, meaning buyers can avoid paying Lenders Mortgage Insurance (LMI).

2. Who is eligible for the Home Guarantee Scheme?

The scheme is primarily designed for first home buyers, but depending on the category, it may also apply to single parents and other groups. From October 2025, eligibility will be broader with fewer restrictions, and higher property price caps. Your Natloans broker can confirm your personal eligibility.

3. How much deposit do I need under the Home Guarantee Scheme?

You only need a minimum 5% deposit. For example, if you are purchasing a $700,000 property, you would need just $35,000 in savings, rather than a full 20% deposit of $140,000.

4. How do the new property price caps help first home buyers?

The expanded scheme significantly increases the maximum property value you can purchase with a low deposit. For example, in Sydney the cap rises from $900,000 to $1.5 million, and in Melbourne from $800,000 to $950,000. This gives first home buyers access to properties in more competitive markets.

5. Do I still have to pay Lenders Mortgage Insurance (LMI)?

No. One of the biggest benefits of the Home Guarantee Scheme is that the Government guarantee takes the place of LMI, saving buyers thousands in upfront costs.

6. Will the scheme affect property prices?

Property experts suggest that the scheme may increase competition in some markets, particularly in capital cities, which could put upward pressure on prices. However, long-term supply and demand factors will also play a role. Acting early with a pre-approval can give you a head start.

7. How do I apply for the Home Guarantee Scheme?

Applications must be made through participating lenders. Working with a mortgage broker like Natloans ensures you access the right lenders, competitive rates, and expert guidance through the application process.