Why reviewing your home loan could save you thousands

When you first took out your home loan, it may have been the perfect fit — but as interest rates, lender policies, and your own financial situation evolve, what was once a great deal can quickly become outdated. That’s why a regular home loan health check is one of the smartest financial habits any homeowner can have.

Just like you service your car, repair your property and look after your own health, your home loan needs regular care and attention to ensure you’re still getting the best possible value.

What is a Home Loan Health Check?

A home loan health check is a simple review of your existing mortgage to see whether your current rate, features, and structure still suit your goals.

During a review, a Natloans expert mortgage broker compares your current loan against more than 50 banks and specialist lenders to identify sharper rates, better features, or smarter ways to manage your repayments. We’ll look at things like:

- Are you paying more interest than necessary?

- Could you benefit from an offset account or redraw facility?

- Has your property value increased, improving your borrowing position?

- Could refinancing consolidate other debts at a lower rate?

Why Natloans Is a Great Mortgage Broker for Home Loan Reviews

At Natloans, we’re proud to be one of Australia’s most trusted and highly-rated mortgage brokers — with nearly 800 five-star Google reviews and more than 10,000 happy clients nationwide.

Our experienced mortgage brokers don’t just compare rates once and move on. We provide a FREE initial home loan health check for new clients, and unlike many banks or brokers, we continue to offer a FREE annual home loan health check every year for our existing clients.

That’s part of what makes Natloans different — we build long-term relationships, not one-off transactions.

How Much Could You Save?

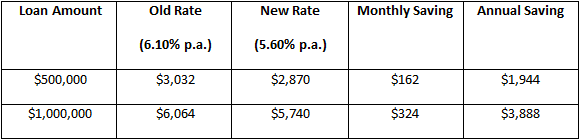

Even a small rate reduction can deliver big savings over time.

Let’s look at what happens when you reduce your home loan rate from 6.10% p.a. to 5.60% p.a. on a standard 30-year principal and interest loan:

(Approximate repayments based on 30-year term, principal & interest, rounded to nearest dollar.)

That’s money that could go straight back into your offset account, your next investment, or simply into your pocket.

The Benefits of Regular Home Loan Health Checks

By reviewing your loan each year, you can:

- Save thousands in interest by securing a sharper rate

- Pay off your mortgage sooner with a better loan structure

- Access equity for renovations or investments

- Consolidate debts into one lower repayment

- Stay competitive as market conditions change

With property values, interest rates, and lender policies always shifting, an annual home loan review ensures you never get left behind paying more than you should.

Book Your Free Home Loan Health Check Today

Whether it’s been six months or six years since you reviewed your mortgage, now’s the perfect time to see how much you could save. See how much you can save, get started on your FREE home loan health check with Natloans today — it could be the most rewarding five minutes you spend all year.

📞 Call us on 1300 955 791

🌐 www.natloans.com.au

Disclaimer: Interest rate figures used are for illustrative purposes only and do not constitute a loan offer or advice. Comparison rate based on a $150,000 loan over 25 years. Warning: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees, or loan amounts might result in a different comparison rate. Always seek advice from your licensed mortgage broker or financial adviser before making financial decisions.